Options to deploy your retirement corpus

In the first two chapters on understanding the significance of retirement planning, we learnt ‘how to calculate your own required retirement corpus and how to identify the monthly investment amount to reach the retirement corpus’

If you have not read the first two chapters, please click here to read them.

In this chapter, we will be discussing the options you have in front of you to deploy the retirement corpus.

There are enough pension policies, schemes, government-aided plans, deposits and dividend pay-out mutual fund schemes available for us.

Well, every such product has been designed to serve the requirement of the retired person, so, there will be significance in each of the products and there will also be some disadvantages which we need to accept. So, the key question which all of us should be able to answer is, what is my requirement.

One of the famous quotes from Steve Jobs “If you define the problem correctly, you almost have the solution”

Similarly, if you get your requirements clearly, it becomes easy for us to get the right solution.

So, rather than finding out what is available, get the list of what you want and we will get you the right solution.

The most common requirements from a retired person could be:

- Liquidity

- Capital Protection

- Regular and consistency in the receipt of interest or returns.

- Increase in interest every year to match the inflation at least

- Tax-free or tax-efficient product

Now, if I have left anything which an investor such as yourself wants, leave us in the comments section. 😊

That leaves us to make a quick comparison with the most popular retirement solutions available currently.

| Particulars / Financial Instruments | Debt Mutual Fund | Fixed Deposit | Senior Citizen Saving Scheme (SCSS)* | Pradhan Mantri Vaya Vandana Yojana (PMVVY) |

| Eligibility | Any Age | Any Age | Age > 60, if VRS, then above 55 | Age > 60 |

| Lock-in Period | No Lock-in | Yes, it depends on the duration you choose | 5 years | 10 years |

| Interest Rate | Depends on Net-YTM and interest-rate movement | 5% to 5.5% for senior citizens – (refered HDFC and SBI Bank) | 7.40% | 7.40% |

| Fixed Return? | No | Fixed for selected tenure. | Guaranteed but rate revised quarterly | Fixed for 10 years |

| Interest paid | No concept of interest rate, you can withdraw as and when you want systematically. | Yes, it depends on what you choose | Quarterly | Month, Quarterly and Yearly |

| Minimum Investment Amount | 1000 | Most likely from 1000 | >1000 | 1.5 lakhs |

| Max Amt | No limit | Most likely no limit | 15 lakhs | 15 lakhs |

| Interest Taxable | Indexation benefit after 3 years | Yes | Yes | Yes |

| Premature liquidity | Liquid-able anytime if it is open-ended funds | Yes with some penalty | Yes with some penalty | Surrender benefit 98% |

| TDS | No TDS | Applicable if the interest amt is more than 50k | Applicable if the interest amt is more than 50k | Not applicable, |

Above are the commonly preferred retirement plans. The annuity from insurance companies is not considered as the IRR (Internal Rate of Return) is comparatively lower.

The next go-to retirement products for retirees are as follows

| Particulars / Financial Instruments | RBI Floating Rate Bond | PPF (Public Provident Fund) | KVP (Kishan Vikas Patra) | NSC (National Savings Certificate) |

| Eligibility | Any Age | Any Age | Above 18 Years | Any Age |

| Lock-in Period | 7 years | 15 years | 10 years and 4 months | 5 years |

| Interest Rate | 7.15% | 7.10% | 6.90% | 6.80% |

| Fixed Return? | Yes | Yes | Yes | Yes |

| Interest paid | Half-yearly | On Maturity | On Maturity | On Maturity |

| Minimum Investment Amount | 1000 | 500 per year | 1000 | 100 |

| Max Amt | no limit | 1.5 lakhs per year to be eligible | no limit | no limit |

| Interest Taxable | Yes | No | Yes | interest earned is virtually tax exempted barring last year. |

| Premature liquidity | Provision available for senior citizens | Partial withdrawals after 6 years | Encash-able after 30 months | Yes with some formalities. |

| TDS | Yes | No | No | No |

* Interest rate and data as on June 2021

Hope this serves what you expect. Yeah, these are the most preferred retirement products by Indian citizens.

Did you know?

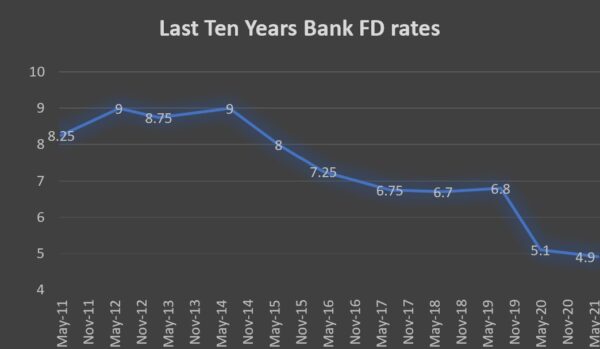

Pradhan Mantri Vaya Vandana Yojana scheme reduced the interest pay-out from 8.3% to 7.4%

Similarly, Senior Citizen Saving Scheme and other such fixed return product’s interest have gone down in the recent months and expect similar rallies in the coming months.

Take a look at how fixed deposit rates historically rallied:

*Source from SBI.co.in *Considered SBI deposit rates

In fact, there are some NBFCs and small banks that offer a higher rate of interest, but they carry downgrading risk which recently we have been witnessing such scenarios.

If you come across an instrument from NBFCs that offers a higher fixed rate of interest, then the immediate question from you should be, ‘Why an established and recognized banks are not able to pay a similar rate?’

Even in debt mutual funds, paying dividends is not a certainty. Even if you have chosen the monthly dividend option for a particular fund, the fund is not mandated to pay out dividends every month. You may go by a fund’s healthy track record of dividend payments, but that doesn’t assure you future dividend consistency.

Amidst all these challenges, the introduction of the SWP option in mutual funds is seen as the right solution.

Why SWP (Systematic Withdrawal Plan):

- Tax Outgo is significantly low compared to any retirement solutions

- Ensures Regular Cash Flow

- High Liquidity

- Withdrawal Amount is flexible and it is in the hands of the investor

- An Equity & Debt Mix in Retirement Solutions under SWP will ensure your corpus grows and not stagnate.

It doesn’t end here, a PLAIN SWP may not come to the rescue given the fact that the required amount keeps increasing year after year due to inflation. So, a Strategic Systematic Withdrawal Plan should help us to cross the bridge.

So, in our next chapter, we will be discussing:

- How SWP works,

- How Tax outgo is very less in SWP compared with Fixed Deposit

Strategic SWP to solve the increase in monthly requirements.

Leave A Comment